Greenman OPEN, one of the largest food-anchored retail real estate investment funds in Germany, has acquired a portfolio of six EDEKA supermarkets for c. €55 million, that GFORM will manage after handover.

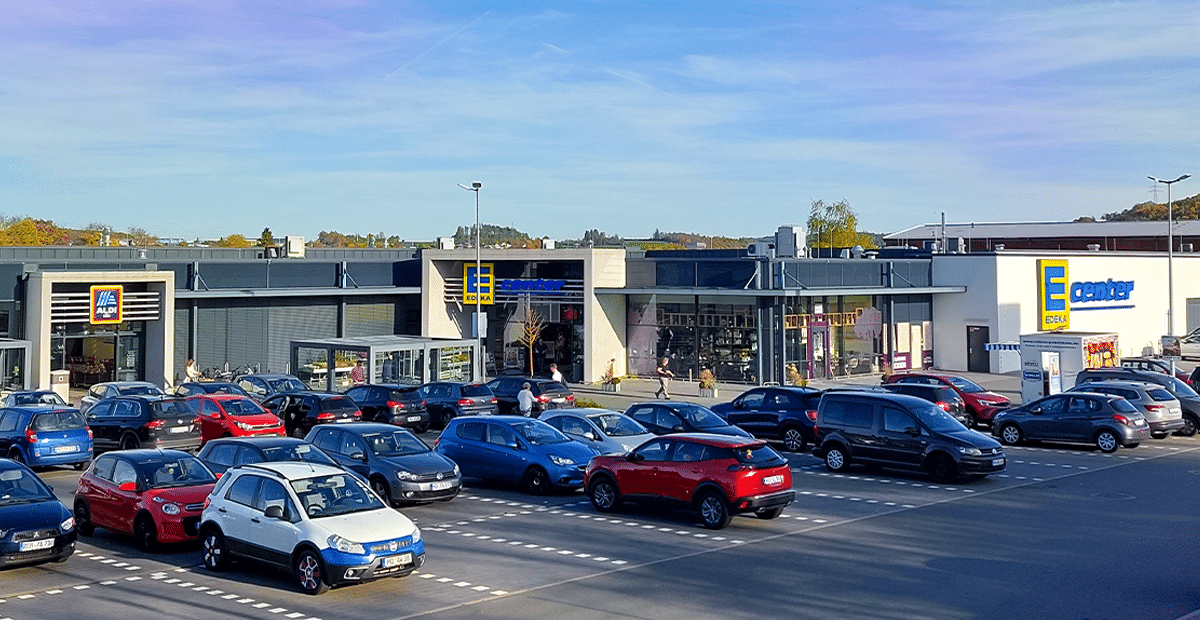

Five of the retail properties are located in the Bavarian towns of Bad Windsheim, Hof, Kemnath, Marktleuthen and Zell am Main, while the sixth is located in Dresden, eastern Germany. The properties which total 20,660 sqm, were acquired directly from EDEKA Northern Bavaria-Saxony-Thuringia under a brand-new long-term sale-and-leaseback agreement. As a result, this will have a positive impact by increasing the fund’s overall WARLT by c. 7% and the rent to term by c. 12.5%.

As part of Greenman’s commitment to ensuring the sustainability of its properties, Greenman Energy will install photovoltaic systems and electric vehicle charging infrastructure at the assets, estimating that the rooftops will have a total annual electricity capacity of 1,000,000 kWh.

James McEvoy, CEO of GFORM, said: “We are delighted to be entering into our sixth sale-and-leaseback agreement with EDEKA, with whom we share a long-standing partnership and a vision for a carbon neutral future. Having a total combined catchment population of c. 500,000, the acquisition of this portfolio really compliments the ever growing Greenman OPEN portfolio and offers long-term and secure income for our fund OPEN through the excellent locations and high footfall and turnover, and we look forward to continuing our partnership with EDEKA for the long-term of owning these assets. Additionally, the assets are going to be equipped with solar panels and hyper-charging infrastructure by our sister company Greenman Energy, and a green lease is exhibiting our commitment to a net-zero future, alongside our ongoing plan to futureproof our properties”.

Stephan Köhler, Head of Strategic Real Estate and Portfolio Management at EDEKA Northern Bavaria-Saxony-Thuringia, adds: “For our expansion strategy in Northern Bavaria we rely on proven cooperation partners. The sale-and-lease-back agreement with Greenman allows us to continue to focus on our core competencies and our sustainable development in the region. Crucial to this is our holistic and sustainable view on properties. We are delighted with this deal with Greenman, to expand our partnership further with a very strong, specialised and reliable partner, whom shares the same long-term vision and goals as us.”

White & Case Frankfurt provided legal support for the acquisitions and Drees & Sommer carried out the technical due diligence for Greenman.